The Cost Inflation Index (CII) is a crucial tool used to adjust for the impact of inflation on various economic indicators and financial transactions. It provides a measure of the cost of living and inflationary pressures experienced by different economies. The CII is released on a quarterly basis by the Department of Statistics and is used to adjust indicators such as the Consumer Price Index (CPI). Additionally, it is utilized to calculate the rate of return on investments, including bonds and stocks.

The calculation of the CII is governed by Section 48 of the Income Tax Act of 1961 in India. This index is employed to determine the index cost of acquisition and the index cost of improvement of capital assets, which are crucial components in the computation of long-term capital gains. The Central Government has the authority to notify the CII for each fiscal year.

Calculating Indexation

Indexation is the process of adjusting the cost of an asset to account for inflation over time. This adjustment is essential to ensure a fair assessment of capital gains or losses when selling the asset. Several methods can be used to calculate indexation, including the Consumer Price Index (CPI), the GDP deflator, and the personal consumption expenditures index.

The most commonly used method is the Consumer Price Index, which tracks changes in the prices of a basket of goods over time. By applying the relevant indexation rate to the original cost of the asset, one can determine its adjusted value. This adjusted value is then used to calculate the capital gains or losses associated with the sale of the asset.

The Importance of Indexation in India

Indexation plays a vital role in maintaining economic stability in India. By adjusting for inflation, indexation helps increase the cost of an asset, thereby reducing the capital gains on its sale. This adjustment ensures that individuals are not taxed on the portion of the gains attributable to inflation. It promotes fairness in taxation and helps investors maintain the purchasing power of their investments.

The Cost Inflation Index is widely used in India to calculate the index cost of acquisition and the index cost of improvement of capital assets. These calculations are necessary for determining long-term capital gains, which are subject to taxation. The index provides valuable information about changes in the average price of goods and assets over time, allowing for a more accurate assessment of capital gains.

Capital Gains and Losses

When selling a property or asset, individuals may be subject to capital gains or losses. Capital gains are the profits made from the sale of an asset, while capital losses occur when the sale results in a decrease in value compared to the original cost. The index cost of the asset is used to calculate the rate of capital gains or losses.

The rate of capital gains or losses is influenced by the indexation rate, which reflects the rate of inflation. Higher rates of inflation result in higher indexation rates, thereby reducing the taxable gains or increasing the allowable losses. The tax treatment of capital gains or losses varies depending on the individual’s tax bracket.

The Role of the Cost Inflation Index in India

In India, the Cost Inflation Index is used for several purposes. Firstly, it helps assess the impact of inflation on the cost of living. The index, based on the Consumer Price Index (CPI), is used to calculate the cost-of-living allowance (COLA) for government employees and pensioners. Secondly, the index is utilized to adjust the income tax brackets and capital gains tax rates.

The Cost Inflation Index is of particular importance when calculating Long Term Capital Gains (LTCG) on various investments and assets such as real estate, gold jewelry, and debt mutual funds. By incorporating the CII into investment statements, individuals can determine the true gain on the sale of an asset. The difference between the sale price and the purchase price is referred to as a capital gains tax (CGT) transaction.

History of the Cost Inflation Index in India

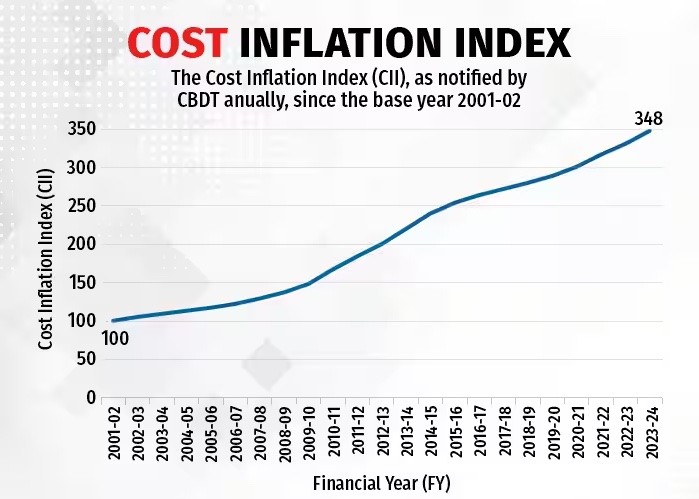

The Central Board of Direct Taxes (CBDT) introduced new Cost Inflation Index numbers for the fiscal year 2017-18 onwards. The base year for the index was changed from 1981 to 2001. This change was made to reflect the changing economic landscape and ensure the accuracy of the index. The new CII table includes data from the financial years 2015-16 to 2017-18.

Conclusion

The Cost Inflation Index plays a crucial role in adjusting for the impact of inflation on various economic indicators and financial transactions. It allows for a fair assessment of capital gains and losses by adjusting the cost of assets to account for inflation over time. In India, the CII is used to calculate the index cost of acquisition and improvement, facilitating the computation of long-term capital gains. It also helps assess the impact of inflation on the cost of living and is used to adjust income tax brackets and capital gains tax rates. The Cost Inflation Index ensures fairness in taxation and helps investors maintain the purchasing power of their investments.