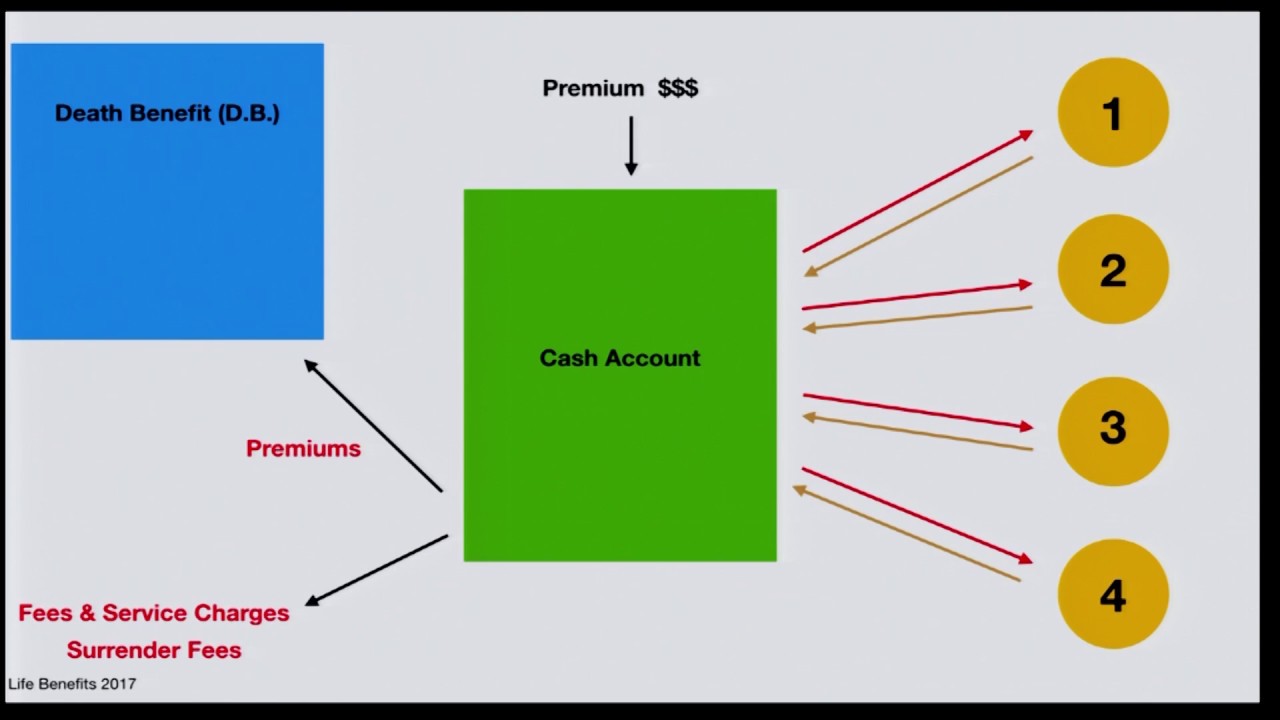

Life insurance is a crucial financial product that provides protection and peace of mind to individuals and their loved ones. It serves as a contract between a policyholder and an insurance company, guaranteeing a sum of money, known as the death benefit, to be paid out to designated beneficiaries upon the death of the insured person. In exchange for this protection, the policyholder pays regular premiums to the insurance company.

Understanding Life Insurance Policies

There are different types of life insurance policies available to meet various needs and preferences. The two main categories are term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance is designed to provide coverage for a specified duration, such as 10, 20, or 30 years. It offers a straightforward and affordable option for individuals seeking temporary coverage. If the insured person passes away during the policy term, the beneficiaries will receive the death benefit. However, if the policy term expires and the insured person is still alive, the coverage ends, and no benefit is paid out.

Term life insurance can be further categorized into different subtypes:

-

Decreasing Term Life Insurance: This type of policy provides coverage that decreases over time. It is often used to cover specific financial obligations, such as mortgage payments, which decrease as the loan is paid off.

-

Convertible Term Life Insurance: Convertible term life insurance allows policyholders to convert their term policy into a permanent policy without the need for a medical exam or underwriting. This flexibility can be beneficial if the policyholder’s needs change over time.

-

Renewable Term Life Insurance: Renewable term life insurance allows policyholders to renew their coverage at the end of the policy term without undergoing a medical exam. However, the premiums for renewable term policies tend to increase annually.

Permanent Life Insurance

Permanent life insurance provides coverage for the entire lifetime of the insured person, as long as the premiums are paid. Unlike term life insurance, permanent policies offer both a death benefit and a cash value component that accumulates over time. There are several types of permanent life insurance:

-

Whole Life Insurance: Whole life insurance is a traditional form of permanent life insurance that offers a guaranteed death benefit and a cash value component. The premiums for whole life insurance are typically higher than those for term life insurance, but the policy remains in force as long as premiums are paid.

-

Universal Life Insurance: Universal life insurance is another type of permanent life insurance that combines a death benefit with a cash value component. It offers more flexibility in terms of premium payments and death benefit amounts. The cash value component earns interest, and policyholders can adjust their premiums and death benefit over time.

-

Indexed Universal Life Insurance: Indexed universal life insurance allows policyholders to earn a fixed or equity-indexed rate of return on the cash value component. This type of policy offers the potential for higher returns while still providing a death benefit and flexibility in premium payments.

-

Variable Universal Life Insurance: Variable universal life insurance allows policyholders to invest the cash value component in separate accounts, such as mutual funds. The cash value and death benefit can fluctuate based on the performance of the underlying investments.

Benefits of Life Insurance

Life insurance offers numerous benefits that can help individuals and their families during difficult times. Here are some key advantages of having a life insurance policy:

-

Financial Protection: Life insurance provides a financial safety net for your loved ones in the event of your death. The death benefit can help cover expenses such as mortgage payments, education costs, and daily living expenses, ensuring that your family’s financial needs are taken care of.

-

Estate Planning: Life insurance can be a valuable tool for estate planning. It can help cover estate taxes, preserve the value of your estate, and provide liquidity to your beneficiaries, allowing for a smooth transfer of assets.

-

Business Continuity: Life insurance can also play a vital role in business continuity planning. It can provide funds to cover the loss of a key employee or business partner, ensuring that the business can continue to operate smoothly.

-

Tax Benefits: The death benefit received from a life insurance policy is generally tax-free. Additionally, some types of permanent life insurance policies offer tax-deferred growth of cash value and tax-free withdrawals or loans against the policy’s cash value.

Who Needs Life Insurance?

Life insurance is not just for specific individuals or situations. It can be beneficial for a wide range of people, depending on their needs and circumstances. Here are some examples of individuals who may benefit from having life insurance:

-

Parents with Dependent Children: If you have children who rely on your income, life insurance can provide financial support to ensure their well-being and future needs are met.

-

Married Couples: Life insurance can help married couples protect each other financially, especially if they have joint financial obligations, such as a mortgage or other debts.

-

Business Owners: Life insurance can be essential for business owners to protect their business and provide funds for succession planning or buy-sell agreements.

-

Seniors: Seniors may need life insurance to cover final expenses, such as funeral costs, and provide financial support to their loved ones after they pass away.

-

Individuals with Debt: If you have significant debts, such as student loans or a mortgage, life insurance can ensure that your debts are paid off in the event of your death, relieving your loved ones of the financial burden.

-

Stay-at-Home Parents: Even if they don’t have an income, stay-at-home parents provide valuable services that would be costly to replace. Life insurance can help cover the costs of childcare, household maintenance, and other responsibilities.

-

Estate Planning: Individuals with significant assets or estate planning needs can use life insurance to provide liquidity and cover estate taxes, ensuring a smooth transfer of wealth to their beneficiaries.

-

Individuals with Pre-Existing Conditions: While it may be more challenging for individuals with pre-existing health conditions to obtain life insurance, it is still possible. Some insurance companies specialize in providing coverage for individuals with specific health conditions.

Factors Affecting Life Insurance Premiums

Several factors can influence the cost of life insurance premiums. Insurance companies consider these factors when determining an individual’s risk profile and premium rates. Here are some key factors that can affect life insurance premiums:

-

Age: Age is one of the most significant factors affecting life insurance premiums. Generally, younger individuals pay lower premiums than older individuals, as they are considered to be at a lower risk of mortality.

-

Health: Health plays a crucial role in determining life insurance premiums. Insurance companies assess an individual’s health through medical underwriting, considering factors such as pre-existing conditions, lifestyle choices, and overall health history.

-

Gender: On average, women tend to live longer than men, resulting in lower life insurance premiums for females.

-

Smoking: Tobacco use significantly increases the risk of various health conditions, leading to higher life insurance premiums for smokers.

-

Occupation and Hobbies: Certain occupations and hobbies, such as skydiving or deep-sea diving, can increase the risk of accidents or injuries, resulting in higher premiums.

-

Coverage Amount and Policy Type: The coverage amount and type of policy chosen also impact the premium rates. Permanent life insurance policies generally have higher premiums compared to term life insurance policies.

It’s important to note that these factors can vary among insurance companies, making it essential to compare quotes and policies from multiple providers to find the best coverage at the most competitive rates.

How to Buy Life Insurance

Buying life insurance requires careful consideration and understanding of your needs. Here are the steps to follow when purchasing life insurance:

Step 1: Assess Your Needs

Begin by evaluating your financial situation and determining the coverage amount you need. Consider factors such as outstanding debts, mortgage payments, education expenses, and the financial well-being of your dependents.

Step 2: Research and Compare Policies

Conduct thorough research on different types of life insurance policies and the insurance companies that offer them. Look for reputable insurers with strong financial ratings and customer reviews. Compare policies, coverage options, and premiums to find the best fit for your needs.

Step 3: Gather Relevant Information

Prepare the necessary information for the life insurance application process. This typically includes personal and family medical history, beneficiary details, and identification documents such as a driver’s license or passport.

Step 4: Apply and Undergo Medical Underwriting

Submit your life insurance application to the chosen insurer. Depending on the policy, you may need to undergo a medical exam and provide additional health-related information. The insurer will assess your risk profile based on this information to determine your premium rates.

Step 5: Review and Sign the Policy

Carefully review the terms and conditions of the proposed life insurance policy. Ensure that it aligns with your needs and expectations. Once satisfied, sign the policy agreement and make the initial premium payment to activate the coverage.

Step 6: Periodic Review and Adjustments

Regularly review your life insurance coverage to ensure it remains adequate for your changing needs. Life events such as marriage, the birth of a child, or significant financial changes may necessitate adjustments to your policy.

Conclusion

Life insurance is a vital financial tool that provides protection and financial security to individuals and their loved ones. It offers various types of coverage, including term life insurance and permanent life insurance, each with its own benefits and considerations. By understanding your needs, comparing policies, and working with a reputable insurer, you can find the right life insurance coverage to safeguard your family’s future. Remember to periodically review and update your policy to ensure it continues to meet your evolving requirements.