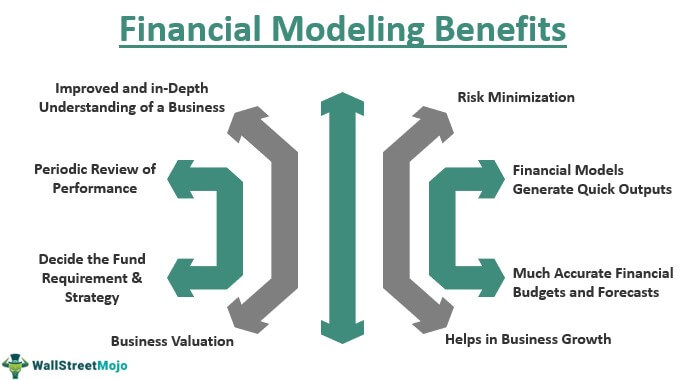

Financial modelling is an essential tool for businesses and individuals alike. Whether you’re forecasting future cash flows, evaluating investment opportunities, or analyzing financial risks, a well-designed financial model can provide valuable insights and help you make informed decisions. In this ultimate guide, we’ll explore some expert tips and tricks to enhance the quality, robustness, and ease of use for your financial models.

1. Build it Better First Time

When creating a financial model, it’s crucial to lay a solid foundation right from the start. One effective strategy is to use centrally controllable variables. Instead of hardcoding values throughout your model, consider pulling frequently used variables into a front sheet. This approach allows you to easily update or change variable values without manually searching for and modifying hardcoded values in multiple places.

Maximizing the use of centrally controlled variables offers several benefits. Firstly, it provides a clear list of assumptions to reviewers, allowing them to quickly understand the model’s underlying assumptions. Secondly, it future-proofs your model by accommodating variables that may become more widely used in the future. By avoiding hardcoded figures, you reduce the risk of inconsistencies. Lastly, having assumptions readily available makes it easier to run “solver” simulations or “what-if” scenarios on a control sheet, rather than searching for and modifying hardcoded assumptions nested within formulae.

2. Use Redundant Ranges for Data Lookup

One common issue with financial models is that they may break when given more input data than originally anticipated. As source data extends beyond the ranges used by lookup formulae or pivot tables, the model’s output may suffer from completeness issues. To avoid this problem, it’s advisable to overestimate the range sizes required for data lookup.

For example, if your current source table contains 300 rows, instruct your lookup formula to search the first 10,000 rows instead. This over-engineering approach doesn’t impact model performance but safeguards against potential errors in the future. By proactively accounting for potential data expansion, you ensure the longevity and accuracy of your financial model.

3. Over-Engineer Your Model

To future-proof your financial model, it’s essential to avoid making manual changes to individual rows without considering the bigger picture. Always strive for consistency when dragging down formulae in an array. While it may be tempting to make quick fixes or tweaks to address bugs or outliers, these ad hoc changes can quickly become unmanageable and hinder future updates.

Consider an example where you perform calculations on a list of employees. If you encounter an employee for whom you don’t want to apply the same calculation, rather than manually modifying the formula in that row, create an additional column to “flag” that individual. Then, use an IF statement to drive a different result for rows containing the flag. This approach maintains homogenous formulae across all rows, enabling you to easily update the model by dragging formulae down with a double click, without worrying about overwriting manually tweaked code.

4. Leverage Financial Modelling Books

If you’re looking for more tips and tricks to enhance your financial modelling skills, consider exploring some of the best financial modelling books available. These resources offer hundreds of practical insights and techniques to improve the quality of your models and save you valuable time in the long run. Some noteworthy financial modelling books to consider include:

5. Mastering the Art of Sensitivity Analysis

Sensitivity analysis is a critical aspect of financial modelling, allowing you to assess the impact of varying assumptions on the model’s outputs. By conducting sensitivity analysis, you gain a deeper understanding of the model’s sensitivity to changes in variables such as interest rates, revenue growth rates, or discount rates.

To perform sensitivity analysis effectively, consider using data tables or scenario analysis. Data tables allow you to vary one or two input variables while observing the corresponding changes in output values. Scenario analysis, on the other hand, involves creating multiple scenarios by adjusting different sets of assumptions and analyzing the resulting outputs. By conducting thorough sensitivity analysis, you can identify key drivers of your financial model and make more informed decisions.

6. Implement Error Checking and Auditing Tools

To ensure the accuracy and reliability of your financial model, it’s crucial to implement error checking and auditing tools. Excel provides various built-in features that can help identify and resolve errors effectively.

One such tool is the “Error Checking” feature, which flags potential errors in your model and offers suggestions for correction. Additionally, the “Trace Precedents” and “Trace Dependents” functionalities allow you to visualize the relationships between different cells and formulae, making it easier to identify and troubleshoot any issues.

By utilizing these error checking and auditing tools, you can minimize the risk of errors in your financial model and enhance its overall reliability.

7. Strike the Right Balance Between Simplicity and Complexity

When designing a financial model, it’s essential to strike the right balance between simplicity and complexity. While a complex model may capture all the intricacies of a business scenario, it can become unwieldy, difficult to understand, and prone to errors.

On the other hand, an overly simplistic model may overlook important variables and fail to provide accurate insights. Aim to create a model that is both robust and user-friendly, capturing the essential elements while maintaining simplicity.

Consider using clear and concise labels, organizing inputs and outputs logically, and providing adequate documentation to guide users through the model. By striking the right balance between simplicity and complexity, you can maximize the usability and effectiveness of your financial model.

8. Test and Validate Your Model

Before relying on your financial model for critical decision-making, it’s crucial to thoroughly test and validate its accuracy. Model testing involves examining the accuracy of calculations, verifying the logic and integrity of formulae, and comparing the model’s outputs with known benchmarks or industry standards.

To validate your model, consider using historical data or publicly available data to compare the model’s outputs with real-world results. Additionally, seek feedback from domain experts or colleagues to ensure the model aligns with their expectations and accurately represents the business scenario.

By rigorously testing and validating your financial model, you can instill confidence in its outputs and make well-informed decisions based on reliable data.

9. Embrace the Power of Visualization

Incorporating effective visualizations can greatly enhance the clarity and impact of your financial model. Excel offers a variety of charting tools that allow you to present data in a visually appealing and easy-to-understand format.

Consider using charts such as column charts, line charts, and pie charts to represent key financial metrics, trends, or comparisons. Additionally, interactive dashboards can provide a comprehensive overview of the model’s outputs, allowing users to explore different scenarios and gain deeper insights.

By leveraging the power of visualization, you can communicate complex financial information more effectively and facilitate better decision-making.

10. Keep Your Model Dynamic and Flexible

Business scenarios and assumptions can change over time, requiring adjustments to your financial model. To ensure your model remains relevant and adaptable, it’s essential to build it with flexibility in mind.

Avoid hardcoding values or assumptions directly into formulae, as this can make the model rigid and difficult to update. Instead, use named ranges or references to external cells, allowing you to easily modify inputs or assumptions without altering the core structure of the model.

Furthermore, consider incorporating dropdown menus or input cells that allow users to select different scenarios or assumptions, facilitating quick and effortless updates.

By keeping your financial model dynamic and flexible, you can accommodate changing business requirements and maintain its relevance over time.

11. Document Your Model Thoroughly

A well-documented financial model is invaluable for both the model creator and future users. Documentation provides clarity, transparency, and a roadmap for understanding and navigating the model.

Include an overview of the model’s purpose, assumptions made, methodology employed, and any key limitations or caveats. Clearly label inputs, calculations, and outputs, and provide explanations or references to external sources where necessary.

Thorough documentation helps users understand the model’s structure, assumptions, and outputs, enabling them to make well-informed decisions based on reliable information.

12. Continuous Learning and Improvement

Financial modelling is a skill that can always be refined and improved. Stay updated with the latest industry trends, best practices, and new tools or functionalities in software like Excel.

Invest in professional development opportunities such as courses, certifications, or workshops to enhance your financial modelling skills. Engage with the financial modelling community through forums, conferences, or networking events to learn from others and exchange valuable insights.

By adopting a mindset of continuous learning and improvement, you can stay ahead of the curve and consistently deliver high-quality financial models.

Conclusion

Financial modelling is a powerful tool that can drive informed decision-making and improve business outcomes. By following these expert tips and tricks, you can enhance the quality, robustness, and ease of use of your financial models. From building a solid foundation to embracing flexibility and continuous improvement, each step plays a crucial role in creating effective financial models. Remember to explore the recommended financial modelling books and leverage the power of visualization and documentation. With a well-designed financial model, you can confidently navigate complex financial scenarios and make informed decisions for the future success of your business.