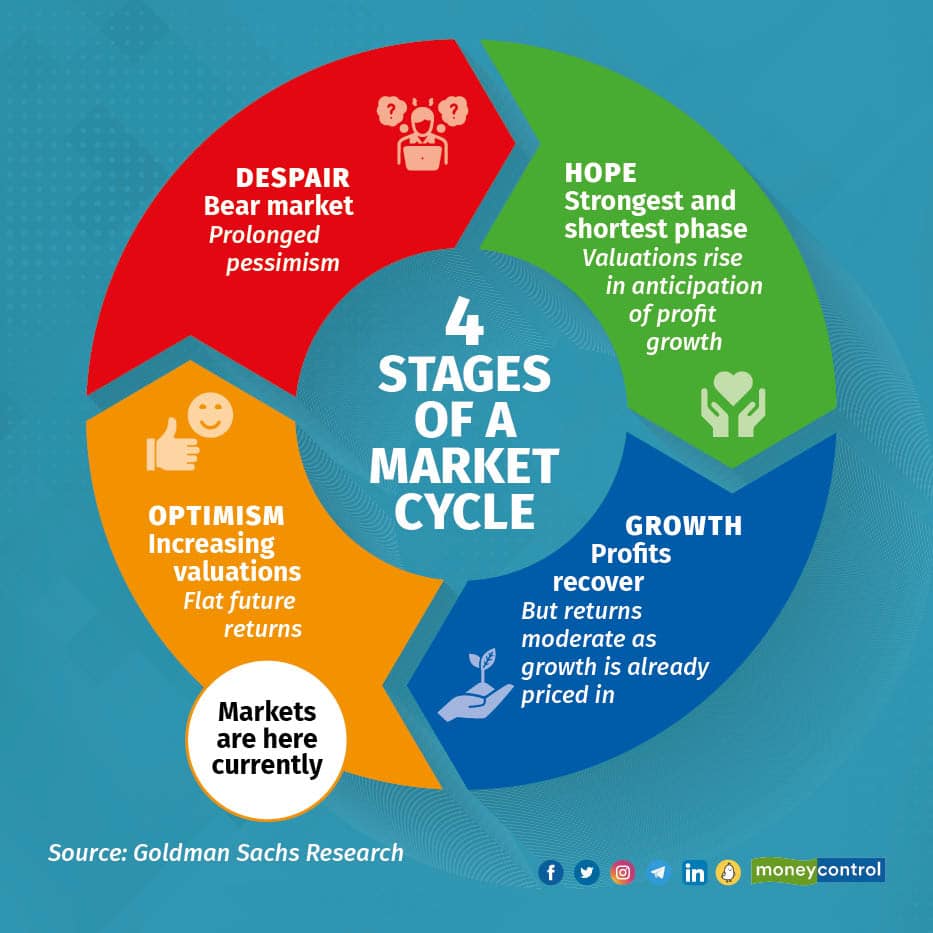

The stock market is a dynamic and ever-changing environment, influenced by a multitude of factors. Understanding the cycles and stages that stocks go through can provide valuable insights for investors seeking to make informed decisions. In this article, we will explore the four stages of a stock market cycle: accumulation, markup, distribution, and markdown. By delving into each stage, we aim to provide a comprehensive analysis of their characteristics and significance. Let’s dive in!

Stage 1: Accumulation

The first stage of the stock market cycle is accumulation. This stage can be observed in individual stocks, specific sectors, or the market as a whole. During accumulation, prices tend to move sideways within a range for an extended period, often lasting for years. Institutional investors play a crucial role in this stage as they gradually accumulate shares.

Institutional investors, such as large funds, need to acquire significant positions in a stock, but they cannot do so all at once. Buying in large quantities could drive prices higher and increase their cost basis. To mitigate this risk, institutional investors buy shares in regular intervals when the stock reaches their desired price levels. This strategic approach provides support for the stock and pushes it slightly higher. Retail investors, on the other hand, may not actively participate during this stage due to the unremarkable price action that fails to attract attention.

Long-term investors can take advantage of the accumulation stage by positioning themselves to scale into or out of positions. Instead of buying everything at once, a “bite-sized” approach allows investors to potentially benefit from better prices in the future. However, it is essential to consider transaction costs when adopting this approach.

Stage 2: Markup

The second stage of the stock market cycle is the markup stage. During this stage, the price of a stock rallies above the resistance level, often accompanied by a spike in trading volume. The breakout from the resistance level attracts investors who did not buy during the accumulation stage.

In the markup stage, price action transitions from neutral to trending. If higher highs and higher lows become evident after a price breakout, it can indicate the beginning of the markup stage. As more buyers enter the market, the uptrend gains strength, potentially becoming parabolic before entering the next stage.

Investors can utilize technical analysis indicators, such as simple moving averages, to track key support and resistance levels during the markup stage. These indicators help investors monitor price movements and make informed decisions. It is crucial for investors to stick to their original trading plan throughout the market cycle, even if the market does not immediately move in their favor.

Stage 3: Distribution

The distribution stage marks the topping phase of a stock, sector, or the overall market. During this stage, early buyers who accumulated shares during the earlier stages may start to exit their positions, alongside later buyers. One characteristic of this stage is an increase in trading volume without a corresponding increase in price.

The distribution stage often witnesses the highest trading volume as bullish sentiment peaks. Initially, new buyers may absorb the selling pressure, but eventually, the stock fails to sustain higher prices. In this scenario, the stock may collapse under its own weight. Chart patterns, such as head and shoulders tops or double tops, can provide indications of the distribution stage. A break below the 200-day moving average can also confirm the end of this phase.

Stage 4: Markdown (or Decline)

:max_bytes(150000):strip_icc()/phasesofthebusinesscycle-c7cb7a3ce6894e86a3e44d5b0fe4d5e2.jpg)

The markdown stage is the final phase of the stock market cycle and one that investors aim to avoid. During this stage, buyers who entered during the distribution phase and are now holding underwater positions start to sell. Since institutional investors have already exited, there are few new buyers to absorb the increased selling pressure. As a result, prices decline rapidly, often accompanied by significant trading volume.

The markdown stage usually ends when a critical support level is breached, leading to a spike in trading volume, signaling an exhaustion of net selling. At this point, the stock may return to the accumulation stage, restarting the cycle once again.

Deep-Dive Research Findings

While the four stages of the stock market cycle provide a general framework for understanding the market’s dynamics, it is essential to consider additional factors that can influence each stage. Deep-diving into research findings can reveal valuable insights. Here are some key findings:

-

Market Psychology: The stock market is profoundly influenced by human psychology. Investor sentiment, market speculation, and emotional decision-making can impact the duration and intensity of each stage.

-

Economic Factors: Economic indicators, such as GDP growth, inflation rates, and interest rates, can significantly influence the stock market cycle. Positive economic conditions can fuel the markup stage, while economic downturns can accelerate the markdown stage.

-

Industry-Specific Factors: Different sectors and industries can experience their own unique cycles within the broader stock market cycle. Understanding the specific dynamics of each industry can provide valuable insights for investors.

-

Technical Analysis: Technical analysis tools, such as chart patterns, moving averages, and volume indicators, can assist investors in identifying the stages of the stock market cycle. These tools help investors make informed decisions based on historical price patterns and trends.

-

Market Timing: Timing the market perfectly is challenging, if not impossible. However, recognizing the stages of the stock market cycle can help investors make more informed decisions regarding asset allocation, risk management, and portfolio rebalancing.

Conclusion

Understanding the four stages of the stock market cycle is essential for investors seeking to navigate the market successfully. By recognizing the characteristics and significance of each stage – accumulation, markup, distribution, and markdown – investors can make informed decisions and potentially capitalize on market opportunities. While deep-diving into research findings enhances our understanding of each stage, it is crucial to remember that the stock market is influenced by a multitude of factors. Conducting thorough research, staying informed, and sticking to a well-defined investment plan can help investors navigate the stock market cycle with confidence.

Remember, the stock market is inherently unpredictable, and past performance is not indicative of future results. Consult with a financial advisor or professional before making any investment decisions.