Economic cycles are a fundamental aspect of the global economy, characterized by periods of expansion followed by contraction. These cycles have a significant influence on various aspects of commercial financing, ranging from interest rates to loan availability. In this article, we will explore the effects of economic cycles on commercial financing and provide insights on how businesses can navigate these shifting waters with the guidance of Equitas Capital Group.

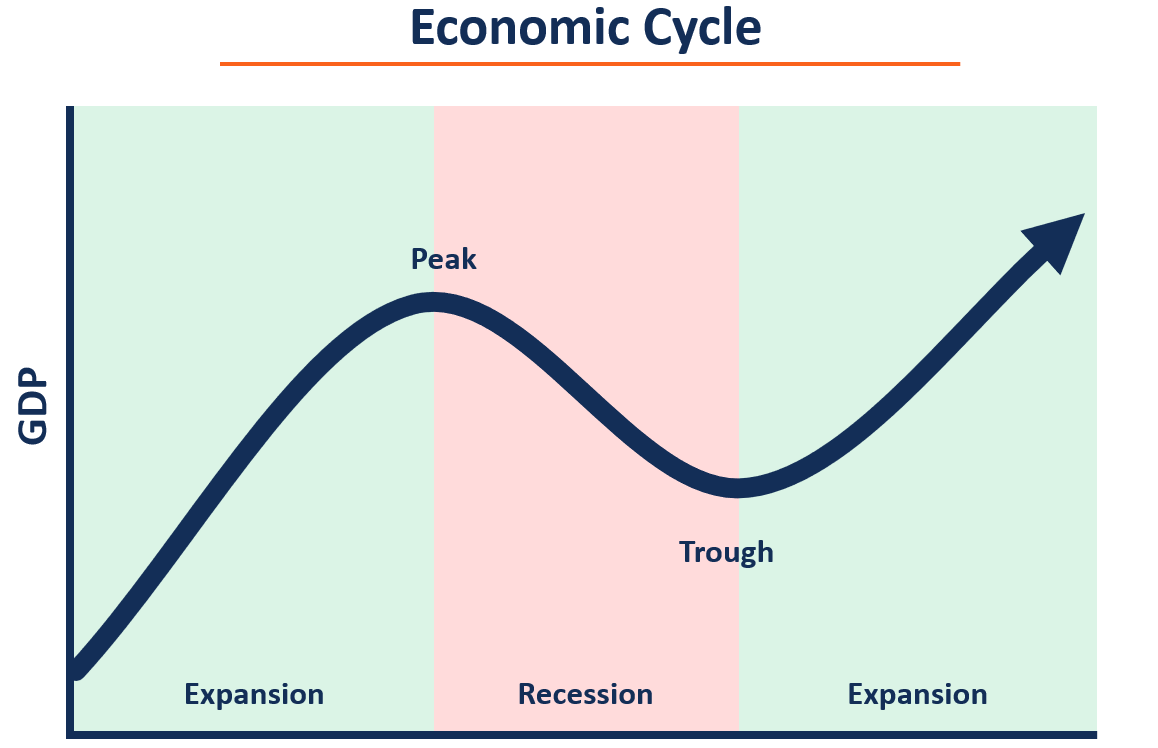

The Four Phases of Economic Cycles

-

Expansion: The expansion phase is marked by a rise in GDP, employment rates, and equity prices. During this phase, borrower confidence increases, making commercial financing more accessible. Lenders become more willing to loan, offering competitive interest rates.

-

Peak: The peak phase represents the zenith of the expansion phase. Economic indicators reach their highest points, potentially leading to overheating. While credit might still be abundant, the first signs of tightening may emerge as risks increase.

-

Contraction (or Recession): The contraction phase is characterized by a drop in GDP, a rise in unemployment rates, and potential stock market declines. Lenders become more cautious, resulting in stricter underwriting standards and reduced lending opportunities.

-

Trough: The trough phase signifies the stabilization of the economy at a lower baseline. While the worst may be over, commercial lenders remain cautious. It is often during this phase that groundwork is laid for the next expansion.

Understanding these four phases is crucial for businesses seeking to navigate the economic cycles and make informed decisions regarding commercial financing.

Influence of Economic Cycles on Commercial Financing

Economic cycles have a profound impact on commercial financing, influencing various factors such as interest rates, lending standards, and loan demand and supply.

Interest Rates

During the expansion phase, central banks may raise interest rates to combat inflation, resulting in higher borrowing costs. Conversely, during recessions, interest rates might be lowered to stimulate borrowing and economic activity.

For example, in a bid to boost an economy in a trough, a central bank might lower interest rates, making commercial loans more affordable and encouraging businesses to invest.

Lending Standards

During robust economic times, lenders may relax their criteria, making it easier for borrowers to secure loans. However, during contractions, lenders become more risk-averse and tighten their loan criteria.

For instance, a commercial project that might easily secure financing during an expansion phase might face more scrutiny or even rejection during a downturn.

Loan Demand & Supply

During expansion phases, businesses seek to capitalize on opportunities, leading to an increase in loan demand. Conversely, during downturns, loan demand can wane as businesses become more cautious.

On the supply side, economic optimism often translates to increased lending, while pessimism restricts lending opportunities.

Navigating Economic Cycles with Equitas Capital Group

Equitas Capital Group is a trusted partner for businesses seeking to navigate economic cycles. They offer strategic advisory services, risk assessment and mitigation, and customized financing solutions tailored to the unique challenges and opportunities of each economic phase.

Strategic Advisory

With their deep understanding of economic intricacies, Equitas Capital Group provides insights that help businesses anticipate and respond to economic phase shifts.

For example, if a recession is on the horizon, Equitas might advise clients to secure long-term financing now to lock in current rates and conditions, safeguarding their financial stability.

Risk Assessment & Mitigation

Equitas Capital Group assists businesses in understanding potential risks associated with economic cycles and provides strategies to mitigate them.

During peak phases, when overheating is a risk, Equitas guides businesses in evaluating if their financing strategies are sustainable in potential downturns. By identifying and addressing potential risks in advance, businesses can proactively protect their financial well-being.

Customized Financing Solutions

Economic phases are not one-size-fits-all, and neither are Equitas Capital Group’s financing solutions. They curate tailored financing strategies to address the unique challenges and opportunities presented by each economic phase.

Equitas works closely with businesses to understand their specific needs and crafts financing solutions that align with their goals and market conditions. This personalized approach ensures that businesses can adapt and thrive in any economic climate.

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

Conclusion

The interplay between economic cycles and commercial financing is intricate and has a significant impact on businesses. While businesses cannot control economic tides, they can certainly learn to navigate them proficiently. With a strategic partner like Equitas Capital Group, businesses gain the knowledge and tools necessary to understand these cycles and leverage them to their advantage.

From personalized advisory services to bespoke financing solutions, Equitas ensures that commercial ventures remain resilient and agile, regardless of the economic climate. By staying informed, assessing risks, and making strategic financing decisions, businesses can thrive in the ever-changing landscape of economic cycles.