Auto insurance rates in Massachusetts are influenced by various factors that determine the cost of coverage. While location plays a significant role, other factors such as age, gender, marital status, credit score, driving record, and coverage level also impact insurance rates. In this comprehensive guide, we will delve into the different categories that affect auto insurance rates in Massachusetts and provide tips on how to save money on your premiums.

Auto Insurance Rates in Massachusetts by Categories

Insurance Rate by Age

Age is an important factor considered by insurance companies to assess the level of driving experience and maturity. Although Massachusetts law prohibits insurers from using age as a direct rating factor, it indirectly affects insurance rates. Younger drivers are typically less experienced and may be considered higher risk, resulting in higher premiums.

On average, a 16-year-old driver in Massachusetts can expect to pay around $5,046 annually for auto insurance. In contrast, a 50-year-old driver would pay approximately $1,030 per year.

Insurance Rate by Gender

While gender is not allowed to be used as a rating factor in Massachusetts, some insurance companies may still consider it when determining premiums. On average, both male and female drivers in the state can expect to pay around $1,150 annually for auto insurance.

Insurance Rate by Marital Status

Unlike in some other states, marital status is not a factor in determining auto insurance rates in Massachusetts. However, in states where it is considered, married individuals tend to receive lower insurance rates due to being perceived as lower-risk drivers. In Massachusetts, average auto insurance rates are generally lower compared to other states, regardless of marital status.

Insurance Rate by City

Auto insurance rates can vary significantly by city in Massachusetts. This variation is attributed to factors such as driving patterns, car repair costs, theft and vandalism rates, and claims frequency. For example, if you reside in Lowell, you may expect to pay approximately 10% higher insurance rates compared to the state average. On the other hand, drivers in Newton enjoy the cheapest rates in the state, with a four percent discount.

Insurance Rate by Credit Score

Unlike some other states, Massachusetts prohibits auto insurers from using credit scores as a rating factor. Therefore, your credit score does not affect your auto insurance rates in the state. On average, drivers in Massachusetts can expect to pay around $1,150 annually for auto insurance, irrespective of their credit score.

Insurance Rate by Coverage Level

The level of coverage you choose for your auto insurance policy also affects the cost of your premiums. Liability-only policies, which provide coverage for damages caused to others, are generally cheaper than full coverage policies that also protect your vehicle. For instance, a liability-only policy with limits of 100/300/100 may cost around $716 per year, while a full coverage policy with the same limits may cost around $1,330 annually.

Insurance Rate for High-Risk Drivers

High-risk drivers, including those with a history of traffic violations or at-fault accidents, generally face higher insurance rates. In Massachusetts, a clean driving record with no claims in the past three years is considered low risk and attracts lower premiums. However, the more violations and accidents a driver has, the more expensive their auto insurance rates become.

For example, the average auto insurance rate in Massachusetts is $1,150 per year. However, a first at-fault collision can increase the premium by an additional $678.18, while the most serious driving offense can result in a rate increase of $1,091.50.

How Driving Record Impacts Auto Insurance Rates in Massachusetts

Your driving record is a crucial factor that insurance companies consider when determining your auto insurance rates. Traffic offenses such as speeding tickets or DUI convictions can lead to surcharges and higher premiums. The severity of the offense and the number of incidents can further increase the impact on your rates.

In Massachusetts, a speeding ticket can raise your insurance rate by approximately 32% of the average premium. At-fault accidents can result in a rate increase of around 68%, while DUI convictions can cause a spike of approximately 90%. It’s important to note that these percentages are based on a single event, and multiple offenses can lead to even higher rate increases.

Tips to Save on Auto Insurance

Although auto insurance rates in Massachusetts are generally lower than in many other states, there are still ways to save money on your premiums. Consider the following tips:

-

Review Your Annual Mileage: If you drive fewer miles annually, you may be eligible for lower insurance rates. Some insurance companies offer discounted rates for low mileage drivers. Additionally, if you work from home or rely on public transportation, you may be a candidate for pay-per-mile car insurance.

-

Check All Discounts: Insurance companies often offer various discounts that can help reduce your premiums. Be sure to inquire about professional or student discounts, as well as any other savings opportunities available to you.

-

Use Driving Habits Test: Some companies offer programs that monitor your driving habits and reward you with lower rates based on your safe driving behavior. If you consider yourself a responsible driver, explore insurance providers that offer these programs.

-

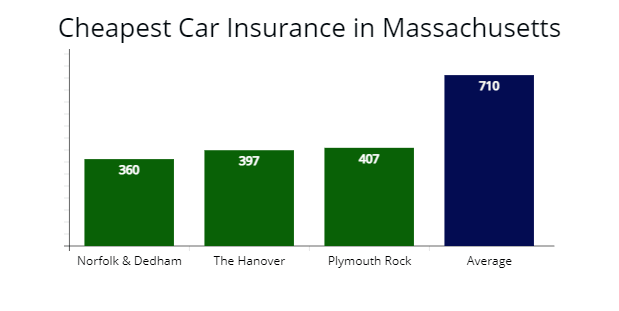

Shop Around: Always compare quotes from multiple insurance companies to find the best rates and coverage options. Taking the time to research and compare will ensure that you select an insurer that suits your needs and budget.

By following these tips, you can potentially save money on your auto insurance premiums while still maintaining the coverage you need.

In Conclusion

Understanding the various factors that affect auto insurance rates in Massachusetts is essential for drivers seeking affordable coverage. While location, age, gender, marital status, credit score, driving record, and coverage level all play a role in determining premiums, there are strategies to reduce costs. By reviewing your annual mileage, exploring discounts, using driving habits tests, and shopping around for the best rates, you can find affordable auto insurance that meets your needs. Stay informed and take proactive steps to save money on your auto insurance in Massachusetts.